[ad_1]

Doubling your money is always challenging, but it’s certainly possible with enough time and the right strategy.

$20,000 is a significant amount of money – so you need to invest wisely to avoid losing money.

In this post, I’ll explore the best ways to double $20k quickly, some investing tips to build wealth, and much more. Let’s get started!

How to Double $20k Quickly

Below are some of the best ways to double $20k and invest your money. Remember to only invest what you can afford to lose and always consult a financial advisor for professional advice.

Crowdfunded Real Estate

Real estate has been one of the most popular and reliable methods to invest your money and generate compound interest for years to come.

But not everyone has the capital to purchase a rental property outright.

That’s where crowdfunding comes in.

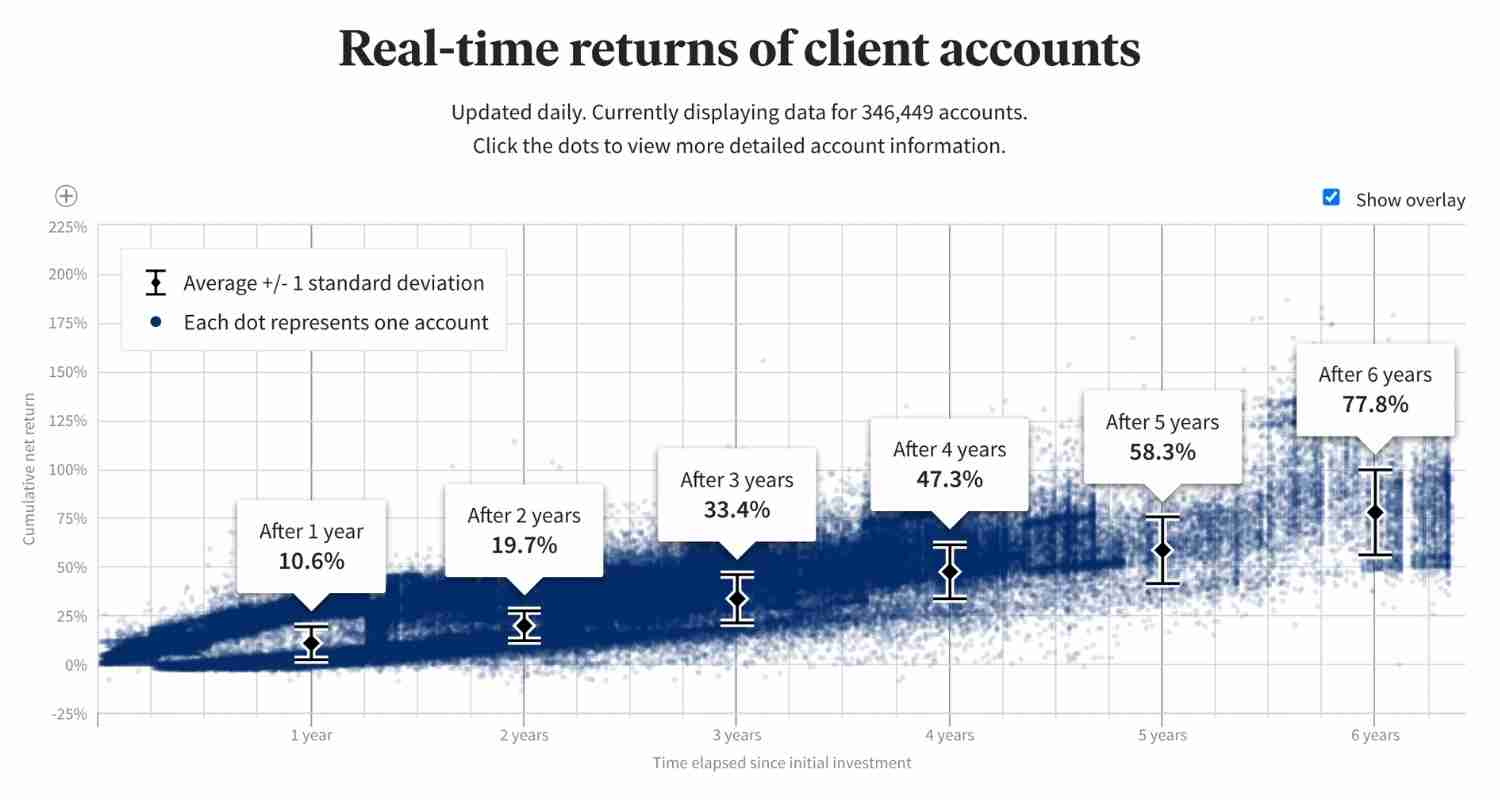

Crowdfunded real estate platforms like Fundrise allow you to pool your money with other investors and purchase a property together and share the profits.

With Fundrise, you can get started with just $10, and they’ll give you $10 free when you create a new account.

Investors typically see annual returns of 10% to 20%, which can help you reach your goal of doubling your money relatively quickly.

Real estate is a great way to double $20k because it is a tangible asset that has a proven track record of delivering strong returns to investors.

Create your Fundrise account below to get started!

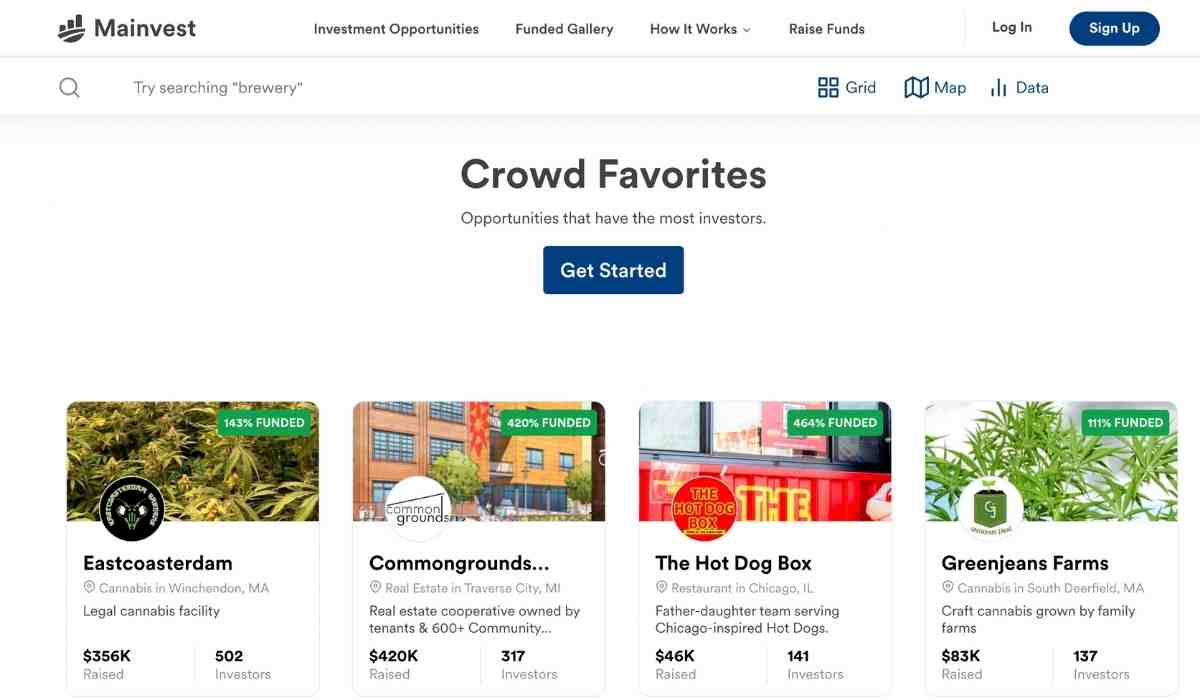

Small Businesses

Small businesses can make great money, but not everyone has the time or money to start a business.

That’s where Mainvest comes into play.

This investing platform allows you to invest in small business across the country with as little as $100. They don’t charge any fees – which allows you to keep more of your capital and generate greater returns.

You can invest in a variety of businesses like restaurants, breweries, and other brick and mortar businesses with ease.

And because they only accept around 5% of businesses that apply to be on the platform, you can be confident that you’re investing in high quality businesses.

The returns on your investment can be very lucrative with target returns between 10% and 25% annually.

While this type of investing is more risky than some of the other options on this list, it can be extremely rewarding if you pick the right business to invest in.

This is also a great way to keep your portfolio diversified – which is always a smart move when investing.

Register with Mainvest below to start investing and you’ll get $10 free!

Index Funds

Investing your money in the stock market is another great way to double $20k and make passive income without much effort.

However, picking individual stocks can be risky, and it’s hard to know which companies will perform well in the future.

A safer and simpler option is to invest in index funds, which are a type of fund that tracks a specific market index, like the S&P 500.

Index funds are a great way to diversify your portfolio and reduce risk because you’re investing in hundreds or even thousands of different companies at once.

Plus, index funds typically have lower fees than other types of funds, which can save you money in the long run.

The average return of index funds is around 7%, but it can be higher or lower depending on the specific index you’re investing in and the current market conditions.

To get started, you can use an investing app like Acorns to invest with as little as $10. As a bonus, you’ll get $10 completely free to invest when you create a new account.

Rental Properties

If you have enough money to start investing in rental properties – this can be one of the most effective ways to double $20,000 and produce passive income from your capital.

When investing in a rental property, you’ll need enough money to fund a down payment for a home, which is usually 20%.

For example, a $100,000 property would require $20,000 for your down payment.

Rental properties are great investments for several reasons:

- First, you’re able to collect rent from tenants every month, which can help you cover your mortgage payments and other expenses associated with owning a rental property.

- Second, over time, the value of your property is likely to increase, which can provide you with a large return on investment when you eventually sell the property.

- Third, as your property increases in value – you can charge more money for rent, which will further increase your profits.

- And fourth, you can take advantage of tax breaks and other benefits that come with owning rental properties.

However, it’s worth also noting the risks that can come with a rental property investment.

Some of the main risks include:

- Missed rent payments – tenants can miss a payment and force you to pay your mortgage out of pocket

- Damage to your property – some tenants might damage your property more than the value of their security deposit in which case you will have to cover the costs to get it in living condition again.

Rental properties are also more work than other types of investments.

For example, you’ll need to find and vet tenants, collect rent, handle repairs and maintenance, and deal with other issues that might come up.

If you don’t want to do the work yourself, you can always opt to hire a property management firm – but this will eat into your profits.

It’s also important to do your due diligence when searching for a property to invest in otherwise you could be stuck with a poor investment.

There’s no doubt that rental properties are more profitable than other forms of real estate investing – but it comes at the cost of risk and work.

If you don’t mind the addition work and risk, it’s one of the best ways to double $20k.

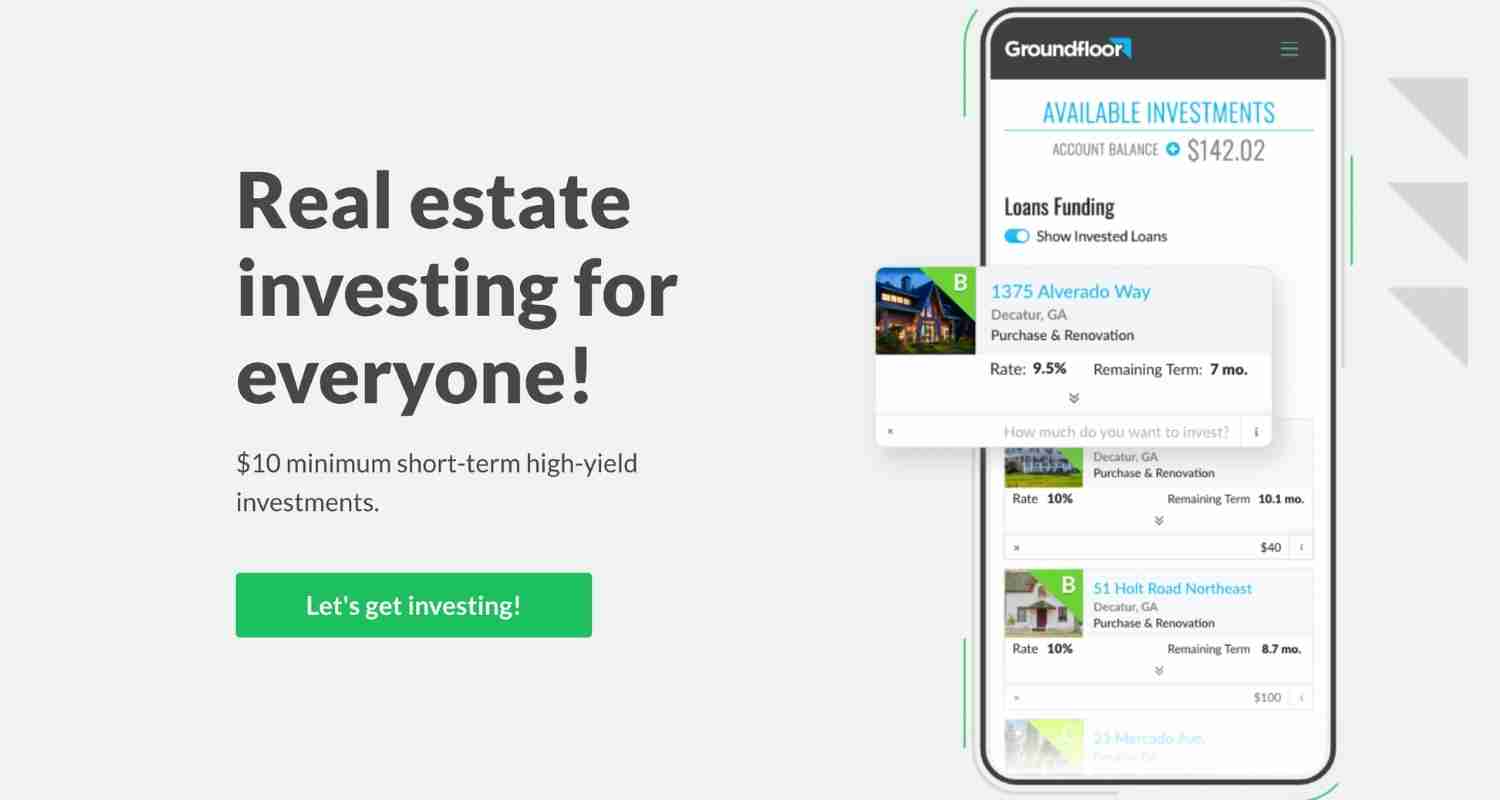

Fund Real Estate Debts

Another non-traditional way to invest in real estate without owning a property is to fund a real estate debt.

You can think of yourself as a hard money lender in this case.

In essence, you’ll lend your money to investors who need capital to complete a project like flipping a home or developing a new property.

These tend to be short term loans, usually less than 6 months.

The benefit of this approach is that you can expect high returns – typically between 10-12%.

You can use a platform like GroundFloor to get started with as little as $10.

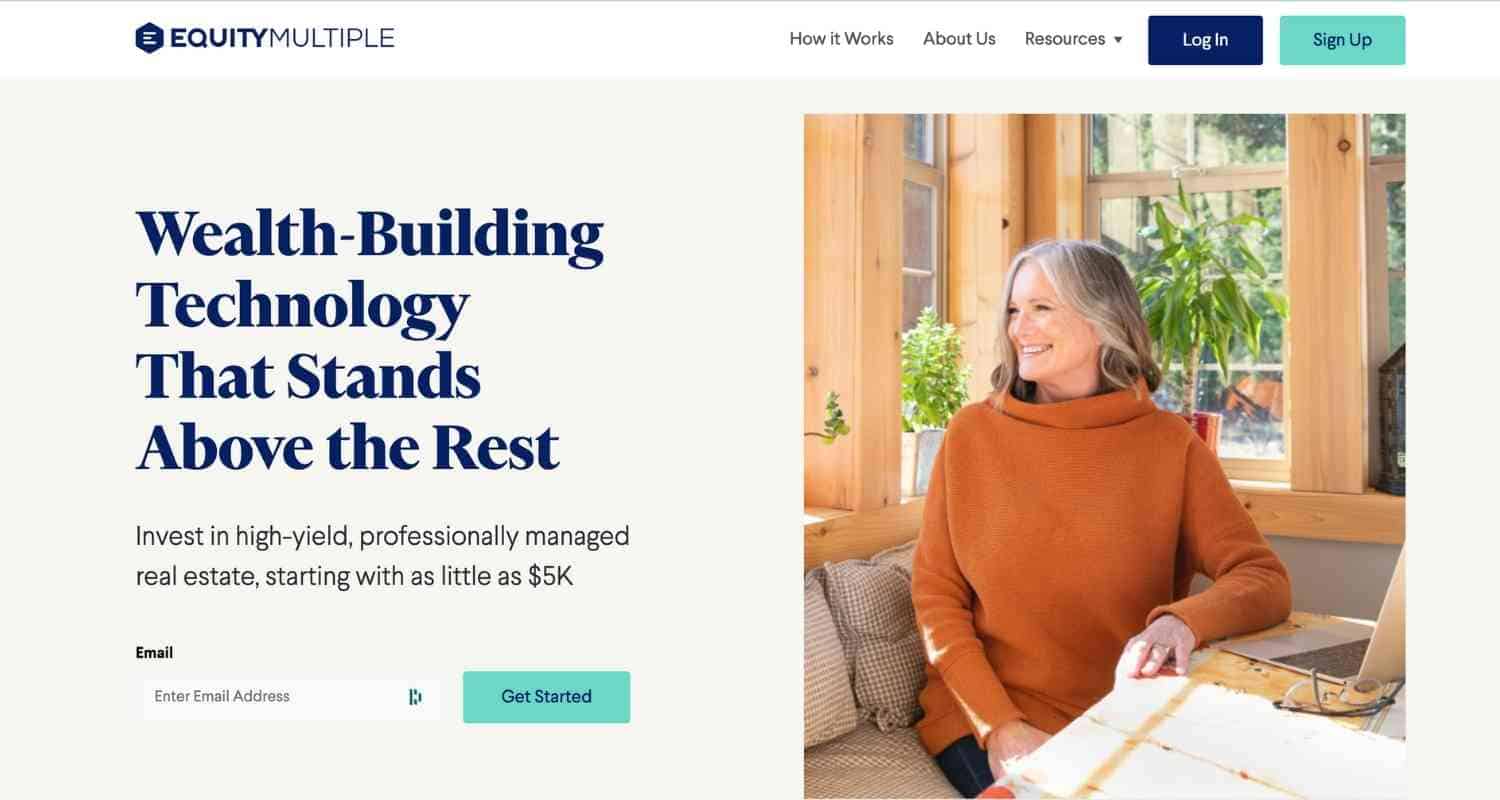

Commercial Real Estate

Whenever you think about real estate, you’re probably thinking of renting out homes or apartment buildings – but there’s more to the industry than that.

Commercial real estate investing is another tremendous opportunity to double $20k and generate passive income.

Commercial real estate includes office buildings, warehouses, retail space, and more.

You might be thinking to yourself “But I don’t have millions to invest!”

The good news is that you don’t have to thanks to platforms like EquityMultiple.

With EquityMultiple, you can invest in real estate assets with just $5,000.

Another bonus is that you can spread your $5,000 across multiple real estate projects to further diversify your investment.

You’ll need to be an accredited investor to use EquityMultiple, so if you haven’t reached this status yet – Fundrise is a better option.

Commercial real estate can be an outstanding way to diversify your investment portfolio and generate passive income.

Cryptocurrency

Cryptocurrency like Bitcoin and Ethereum can be great assets to add to your investment portfolio – but they can also be incredibly volatile.

Some people have made fortunes investing in crypto, while others have lost everything they put in.

Cryptocurrency is still a relatively new new asset class, and there’s a lot of uncertainty surrounding it.

So, if you’re going to invest in cryptocurrency, you need to be prepared for the possibility of big losses.

You can get started with a platform like Coinbase or Gemini with as little as $1.

ETFs

ETFs, or exchange traded funds, are a type of investment that allows you to invest in a basket of assets.

For example, the Vanguard S&P 500 ETF gives you exposure to the 500 largest companies in the US.

ETFs are a great way to diversify your investment portfolio and reduce risk. They also have some of the lowest management fees – allowing you to keep more of your money.

The average ETF return over the last 10 years has been around 7% – which is a solid return from your investment.

You can use a platform like Acorns to get started.

Starting a Blog

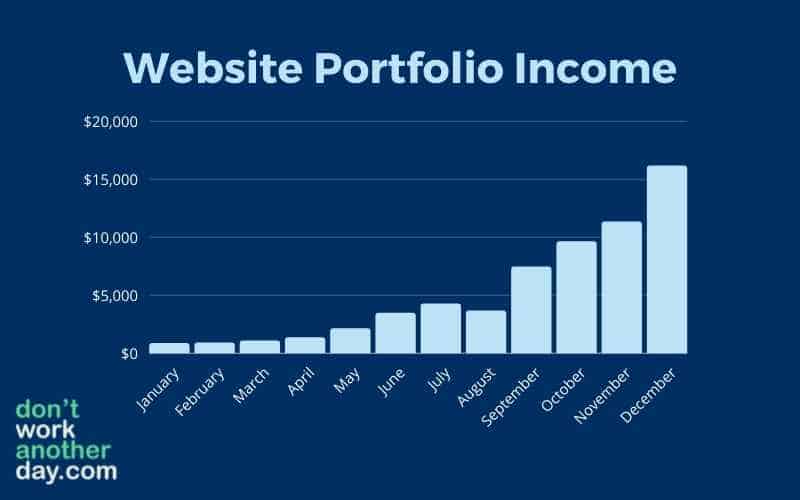

Starting an online business or blog is a unique way to start investing in digital assets to generate income.

Blogs and websites are great examples of digital real estate that you can leverage to turn your money into more money.

Building a blog can take a serious amount of time, but luckily that’s not your only option.

You can use online brokers like EmpireFlippers or Flippa to buy online businesses that generate cash flow.

There are a few main reasons why I recommend online businesses to double $20k.

- Extremely high income potential

- Recurring revenue – once you have a site set-up it can generate income for months or even years to come without much work

- Ability to work from anywhere and anytime

- Costs little to get started (check out some of the best blogging equipment to get started)

While starting a blog or online business won’t make you a millionaire overnight – it can be a great way to start generating passive income and is an awesome high paying side hustle for anyone.

How much can you really make?

It’s possible to make $20k a month or more for some bloggers. While it can take some time to reach these levels of income, it’s definitely possible.

It took me about 2 years to make $10k a month from my portfolio of blogs and online businesses.

Of course, I wasn’t just focused on making money – I was also building a business that I enjoyed and that gave me the freedom to work from anywhere in the world.

If you’re looking for a way to double your money and make some serious profits, starting an online business is one of the best options out there.

Flipping

Are you searching for a side hustle you can start with little money?

Flipping could be for you!

The amount of money you can make from flipping depends on how hard you work and the amount of effort you put in.

The process is extremely simple to navigate. You’ll need to purchase things for a discount and sell them for a profit.

There are many different things you can flip – from houses to furniture to clothes and much more.

To find products to flip, you can check Facebook Marketplace, Craigslist, garage sales, and thrift stores.

Once you find an item to flip, it’s time to sell it!

You can sell your items online on platforms like eBay, Facebook Marketplace, and Craigslist.

If you want to maximize your earnings when flipping, there are a few things you can do:

- Refurbish items – Take the time to refurbish your items before selling them. This can include cleaning, repairing, and painting.

- Take quality photos – Good quality photos will make your items look more appealing to buyers and help you sell them faster.

- Write quality descriptions – Just like with photos, quality descriptions will help your items sell faster.

- Provide transportation – If you’re selling large items, offer to transport them to the buyer’s house. This will help you sell your items faster and for a higher price.

While flipping won’t make you a millionaire, it’s a great way to make some extra money on the side and you can get started with $20k or much less.

High Yield Savings Account

If you’re looking for the safest way to grow your money, investing your money in a high yield savings account can be an easy way to make money while you sleep.

With this method, you’ll be able to earn interest on your money without having to worry about it because they are FDIC insured.

There are many different banks that offer high yield savings accounts, but I recommend using CIT Bank because they offer some of the highest interest rates available and you only need $100 to open a new account.

Final Thoughts on How to Double $20k

Investing your money is essential if you want to reach financial freedom and achieve your long-term financial goals.

There are a lot of different ways to invest your money – and the best way to double $20k will depend on your individual circumstances.

If you’re looking for a safe investment with little risk, investing in bonds is a good option

Download My FREE Income Ideas Cheat Sheet!

Make. More. Money. Join 15,000+ subscribers learning how to boost their income and take control of their finances.

Don’t worry – we hate spam too. Unsubscribe at any time.

[ad_2]